This week is expected to banks included in the Ibex 35 announced that the benefits of 2018 amount to 17,000 million euros, which would mean an increase of 21%.

Banco Santander has a net profit of 7,810 million euros, which would be 18% more than recorded in 2017.

That is, since 2008 has earned more than 70,000 million euros and its fiscal balance by the companies has been negative 1,900 million, ie what is known as "a return" ...

-Follow reading, below we will continue with Santander-

And not just the Santander will present great benefits ...

In the case of BBVA, it is possible that the bank registered 5,172 million euros, which would mean an improvement of 46% compared to 3,519 million euros a year earlier.

As for CaixaBank, the market expects a net profit of 2,081 million euros compared to 1,684 million the Catalan organization recorded a year earlier, representing an improvement of 23.5%.

Sabadell, which also publishes its accounts on Friday, still affected by the problems of its British subsidiary. In fact the net profit for the whole year will fall by 56% to 346 from 801 million euros.

Bankia will also lower its profits by 3% to 791 million.

And Bankinter (data published last week) achieved a record $ 526.4 million profit in 2018, representing an increase of 6.3%.

You imagine that these banks pay a 25% corporate tax as do SMEs. We would be talking about more than 4,000 million euros to the coffers of the Spanish State.

Well , no, it's zero, and has for years been zero euros ...

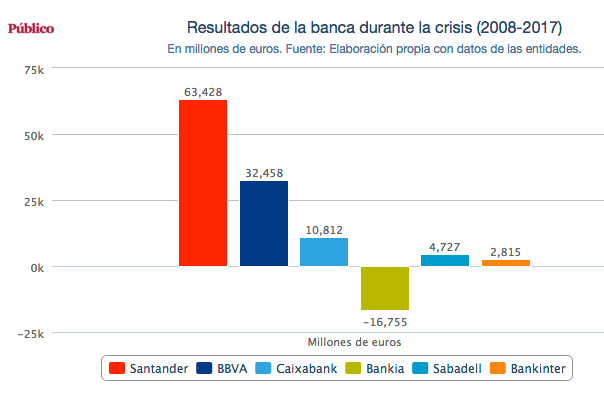

The six largest Spanish banks (Santander, BBVA, CaixaBank, Bankia, Sabadell and Bankinter) have not paid, overall, not a single euro from corporation tax the onset of the economic crisis , despite winning 84,000 million in the meantime. This follows from the data entities themselves provided the Comisión Nacional del Mercado de Valores (CNMV), as is required, between 2008 and 2017.

The tax bill that period, considered as a whole, has even been good for them, to generate a credit balance of 164 million euros in round numbers (counting all banks, not only the Ibex).

In other words, Hacienda, "the people", there has not only had a net income from the application of corporation tax to the benefits of the big banks, but had to return money from all Spaniards.

This is due to the specific advantages enjoyed by the financial sector taxation and in addition to the deductions that can be applied other companies. Banks generate tax credits, which can be activated in the following years, by writedowns, for contributions to pension plans for their workers compensation or benefits with previous losses.

In the last ten years, the company has reaped more profits is by far the Santander (63.428 million euros), but its fiscal balance has been negative Companies 1,900 million. The bank presided Ana Botin leaves will not pay this tax since 2011, although it has never incurred losses, even in 2017, when it absorbed the Popular, a bank that was supposedly imminent bankruptcy.

On the contrary, the only one of the six major financial institutions with accumulated losses since 2008 is Bankia (16.755 million euros), due to the huge hole that I recorded in 2011 and 2012, coinciding with the passage of Rodrigo Rato for his presidency. While returning to the benefits paid by companies in the last five years, the fiscal balance of the decade followed resulting favorably 2,641 million.

Of large organizations that have made money since the outbreak of the economic crisis, only three have been unable to avoid paying the IRS throughout the period: BBVA (3.397 million euros), Sabadell (503) and Bankinter (787). CaixaBank has had a bill in your favor 583 million.

|

| Add legend |

Anyway