Mirador - Observatoire des multinationales critique

| Translated from French to rebellion Beatriz Morales Bastos |

The distribution group Carrefour has announced a major global restructuring that will affect thousands of workers in the group. We offer u na look back at the details of this plan and the evolution of secto r.

The Carrefour group is one of the pioneers of large - scale distribution in Europe. In 1963 this chain [hypermarket] was one of the first to launch a new format that already existed in the United States, the hypermarket. This type of store offers a variety of products under one roof, huge parking for customers and low prices (especially fuel), a revolution at the time when mass consumption came. Hypermarkets, whose surface is over 2,500 m², are generally implanted on the periphery of major cities and are often associated with commercial galleries offering complementary services and contribute to the attractiveness of the location. This model successfully developed in the 1970s.

Significant sales volumes allow distributors to impose their own conditions to suppliers and propose better prices to consumers

A format that loses speed

The hypermarket will meet its golden age in the 1980s and 1990.

In the early 2000s more than 51.8% of purchases of French food products are made in hypermarkets, compared with 37.5% in 1980 [1].

At the same time the supermarkets, who see chains that offer deep discounts they hac competition, begin to increase their surface, increase product range and expand the assortment offered, which compete turn with hypermarkets. Hypermarket model will reach saturation in the late 2000s, especially in mature economies where consumption levels no longer know the exponential growth of the 1960s and 70s.

From the point of view of profitability for strings, the hypermarket is not the most profitable respect to the commercial area format: indeed, the volume of sales per square meter is lower in hypermarkets than in local shops or supermarkets. The sales growth now occurs in the latter two formats while hypermarkets stagnates [2]. We must also seek the crisis hypermarket model in the growing lack of consumer interest in this type of format, considered often cold and impersonal. The growing competition from specialty stores and trade online

(with Amazon to the head), which offer assorted wider than those of the great "traditional" distribution and effective services of delivery, has also played a role in the relative decline of large generalized surfaces (offering food and non food). No shortage of reasons for the loss of interest in this business model increasingly reluctant consumers to deal with traffic and consume energy to go to hypermarkets, average time for too long shopping in some stores that have 300 to 400,000 references compared to local trade chains with a smaller range ...

Repeated scandals two decades (mad cow eggs with fipronil, horsemeat, chicken with dioxin, sprouted seeds and bacteria E. coli, salmonella - tainted milk ...) does have also contributed to degrade the image of the great distribution, principal instead of selling the products incriminated. Still, the group does not intend to dispense with its hypermarkets, one of the brands of Carrefour. Its hypermarkets still accounts for almost half of its sales volume and remain an important element to maintain its market share.

Because freight volumes representing hypermarkets also have an impact on the group's ability to obtain favorable commercial terms suppliers. Indeed, the most important are the volumes purchased by these distributors have more ability to negotiate lower prices with suppliers, who are increasingly dependent on their customers [3]. The challenge of the recent demonstrations in the agricultural world, especially in the milk sector, prices were mostly negotiated by large retailers (and food industries). L a strategy "Plassat"

The arrival in 2007 of the new shareholders Colony Capital, a fund of Anglo - Saxon investment, and Bernard Arnault (which remains the main shareholder of the group) coincides with a strengthening of the requirement of return on equity (*) Company. Between 2007 and 2009 the benefits of the Carrefour group sink and spend 2,200 million euros to 327 million. However, in the same period it continues to increase the share of these same profits distributed to shareholders, dividends. In 2009 the share of the profits distributed to shareholders reaches 229%. How can a company distributed profits which does not generate? For example, selling parts of the company. Carrefour reduced its size and employment to satisfy their shareholders.

As shown in the graph reproduced below, employment in the Carrefour group goes from 495,287 workers in 2008 to 364,969 in 2012. With the sale of subsidiaries or closing stores worldwide the French chain reduces its scope and its costs to increase standard profitability. However, the Group's debt remains an obstacle to attracting new investors.

This strategy to attract new investors does not seem to bear fruit in the long term. Indeed, after two years boom group benefits fall back from 2014 (Figure 1). Bompard does it again! In July 2017 Georges Plassat gives way to Alexandre Bompard, former student of ENA [National School of Administration], exconsejero of François Fillon at the Ministry of Labor, went through Canal +, former Director General of Europe 1 and after the Fnac, a which recently it merged as Darty. Only six months after arriving Alexandre Bompard has a first restructuring plan for the distribution giant.

euphemistically called "transformation plan" in fact it is a restructuring of large magnitude whose first objective is to reduce the costs of the distributor and its wage bill, and focus on the most profitable activities, such as fresh produce, organic products and retail brands. Thus, the strategy Bompard is not so different from its predecessor.

This plan includes several areas: simplification of the organization (meaning reduced employment at the headquarters in Paris, that is, 2,400 workers concerned a total of just over 10,000), increased productivity (making the same turnover with less personal, small retail outlets and through increasing automation, especially in logistics, order picking, boxes ...), development of trade online and "drives" [campaigns] (allowing sell less personal and commercial space) and reorientation proximity formats (the most franchisees and working conditions and less advantageous collective agreements in hypermarkets).

In addition to these measures it should be noted the closure of 273 stores Dia in Spain (that will be sold or closed) and the group 's willingness to accentuate its development in growth areas: in Brazil, Argentina and especially in China, where the group has launched a partnership with Tencent and Yonghi, a giant Chinese internet and specialist fresh produce and small distribution formats. The group expects to save about 2,000 million euros by 2020, it plans to invest in trading online and in new formats proximity: there where fixed costs are less important and high margins.

While it has clearly announced the elimination of 2,300 jobs at the group's headquarters, the CEO of Carrefour has nothing stated about the effects of this plan on the overall employment group.

In France, in addition to the 2,300 layoffs announced, are threatened almost 5,000 additional posts [4], especially in hypermarkets will reduce its surface. For integrated hypermarkets (managed by the Carrefour group and not franchise) another plan of "simplification and centralization" is planned but has not been announced and aims to reduce administrative positions and to eliminate the positions of cashier at service stations. They would be concerned 500 jobs.

Because of its ambitions in trading online group has acquired an important logistics center. This center dedicated to the preparation of orders online will be automated and will help to decrease progressively three staff of drives [5].

Similarly, the establishment of partnerships in certain sections, as with Fnac-Darty for household, raising fears the removal of a number of jobs unquantified at present. Dia store closures in Spain will not fail to cause job losses. Indeed, supermarkets do not find buyer will throw the closing, which poses a threat to the 2,100 Spanish workers concerned.

Finally, several establishments in the group will advance to the situation leasing and management (franchised), which will coincide with the degradation of working conditions and social benefits of workers in these stores. In total, and although the group does not provide any precise figure, counting under his breath more than 10,000 jobs that could be eliminated worldwide because of this transformation plan. Plan e s partner mass les Carrefour is not the only supply chain has announced restructurings and job cuts over recent years.

The most recent cycle began with Delhaize in 2014 preparing his Ahold fusion [6]. Cora [7] and Makro [8], two actors present in the segment of hypermarkets in Belgium have also announced restructurings in recent months.

Auchan in France is the other specialist French hypermarket chain in unveiling a restructuring plan in 2016 [9].

US Walmart, the leading distributor in the world, announced in early January reductions in troops and closing 63 stores Sam's Club [10], while Britain 's Tesco embarks on a third restructuring [11] in a year. In total they are deleted several tens of thousands of jobs in the distribution sector over recent years between the world's leading distributors. In Belgium, "a new social slaughter" Belgium has not been spared from this restructuring plan. Although no figure concerning some escaped to Belgium in the announcement of Alexandre Bompard, Belgian workers waited nervously fell the news.

On 25 January 2018 the direction of Carrefour Belgium announces that the restructuring plan could cost 1,233 jobs in the country. Accept a difficult announcement given the changes in recent years in the Belgian subsidiary.

The hypermarket will meet its golden age in the 1980s and 1990.

In the early 2000s more than 51.8% of purchases of French food products are made in hypermarkets, compared with 37.5% in 1980 [1].

At the same time the supermarkets, who see chains that offer deep discounts they hac competition, begin to increase their surface, increase product range and expand the assortment offered, which compete turn with hypermarkets. Hypermarket model will reach saturation in the late 2000s, especially in mature economies where consumption levels no longer know the exponential growth of the 1960s and 70s.

From the point of view of profitability for strings, the hypermarket is not the most profitable respect to the commercial area format: indeed, the volume of sales per square meter is lower in hypermarkets than in local shops or supermarkets. The sales growth now occurs in the latter two formats while hypermarkets stagnates [2]. We must also seek the crisis hypermarket model in the growing lack of consumer interest in this type of format, considered often cold and impersonal. The growing competition from specialty stores and trade online

(with Amazon to the head), which offer assorted wider than those of the great "traditional" distribution and effective services of delivery, has also played a role in the relative decline of large generalized surfaces (offering food and non food). No shortage of reasons for the loss of interest in this business model increasingly reluctant consumers to deal with traffic and consume energy to go to hypermarkets, average time for too long shopping in some stores that have 300 to 400,000 references compared to local trade chains with a smaller range ...

Repeated scandals two decades (mad cow eggs with fipronil, horsemeat, chicken with dioxin, sprouted seeds and bacteria E. coli, salmonella - tainted milk ...) does have also contributed to degrade the image of the great distribution, principal instead of selling the products incriminated. Still, the group does not intend to dispense with its hypermarkets, one of the brands of Carrefour. Its hypermarkets still accounts for almost half of its sales volume and remain an important element to maintain its market share.

Because freight volumes representing hypermarkets also have an impact on the group's ability to obtain favorable commercial terms suppliers. Indeed, the most important are the volumes purchased by these distributors have more ability to negotiate lower prices with suppliers, who are increasingly dependent on their customers [3]. The challenge of the recent demonstrations in the agricultural world, especially in the milk sector, prices were mostly negotiated by large retailers (and food industries). L a strategy "Plassat"

The arrival in 2007 of the new shareholders Colony Capital, a fund of Anglo - Saxon investment, and Bernard Arnault (which remains the main shareholder of the group) coincides with a strengthening of the requirement of return on equity (*) Company. Between 2007 and 2009 the benefits of the Carrefour group sink and spend 2,200 million euros to 327 million. However, in the same period it continues to increase the share of these same profits distributed to shareholders, dividends. In 2009 the share of the profits distributed to shareholders reaches 229%. How can a company distributed profits which does not generate? For example, selling parts of the company. Carrefour reduced its size and employment to satisfy their shareholders.

Chart 1. Carrefour: profits and dividend or s

Legend: blue, benefits; orange, dividends. Source: Mirador-multinationales.be

Chart 2. Carrefour: empl eo Total

Source: Mirador-multinationales.be

Accordingly, the debt reduction strategy will be the main Georges Plassat, Alexandre Bompard predecessor at the head of the French group between 2012 and 2017. To do this, Carrefour will sell or close its stores in the countries where it is not number 1 . The French multinational leaves Colombia, Greece and Turkey dissociates.

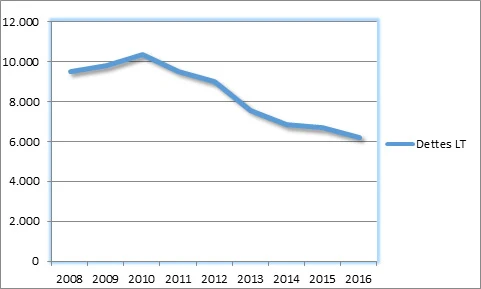

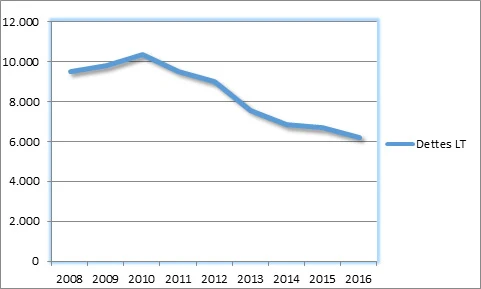

Chart 3. Carrefour: long - term debt

Source: Mirador-multinationales.be

euphemistically called "transformation plan" in fact it is a restructuring of large magnitude whose first objective is to reduce the costs of the distributor and its wage bill, and focus on the most profitable activities, such as fresh produce, organic products and retail brands. Thus, the strategy Bompard is not so different from its predecessor.

This plan includes several areas: simplification of the organization (meaning reduced employment at the headquarters in Paris, that is, 2,400 workers concerned a total of just over 10,000), increased productivity (making the same turnover with less personal, small retail outlets and through increasing automation, especially in logistics, order picking, boxes ...), development of trade online and "drives" [campaigns] (allowing sell less personal and commercial space) and reorientation proximity formats (the most franchisees and working conditions and less advantageous collective agreements in hypermarkets).

In addition to these measures it should be noted the closure of 273 stores Dia in Spain (that will be sold or closed) and the group 's willingness to accentuate its development in growth areas: in Brazil, Argentina and especially in China, where the group has launched a partnership with Tencent and Yonghi, a giant Chinese internet and specialist fresh produce and small distribution formats. The group expects to save about 2,000 million euros by 2020, it plans to invest in trading online and in new formats proximity: there where fixed costs are less important and high margins.

While it has clearly announced the elimination of 2,300 jobs at the group's headquarters, the CEO of Carrefour has nothing stated about the effects of this plan on the overall employment group.

In France, in addition to the 2,300 layoffs announced, are threatened almost 5,000 additional posts [4], especially in hypermarkets will reduce its surface. For integrated hypermarkets (managed by the Carrefour group and not franchise) another plan of "simplification and centralization" is planned but has not been announced and aims to reduce administrative positions and to eliminate the positions of cashier at service stations. They would be concerned 500 jobs.

Because of its ambitions in trading online group has acquired an important logistics center. This center dedicated to the preparation of orders online will be automated and will help to decrease progressively three staff of drives [5].

Similarly, the establishment of partnerships in certain sections, as with Fnac-Darty for household, raising fears the removal of a number of jobs unquantified at present. Dia store closures in Spain will not fail to cause job losses. Indeed, supermarkets do not find buyer will throw the closing, which poses a threat to the 2,100 Spanish workers concerned.

Finally, several establishments in the group will advance to the situation leasing and management (franchised), which will coincide with the degradation of working conditions and social benefits of workers in these stores. In total, and although the group does not provide any precise figure, counting under his breath more than 10,000 jobs that could be eliminated worldwide because of this transformation plan. Plan e s partner mass les Carrefour is not the only supply chain has announced restructurings and job cuts over recent years.

The most recent cycle began with Delhaize in 2014 preparing his Ahold fusion [6]. Cora [7] and Makro [8], two actors present in the segment of hypermarkets in Belgium have also announced restructurings in recent months.

Auchan in France is the other specialist French hypermarket chain in unveiling a restructuring plan in 2016 [9].

US Walmart, the leading distributor in the world, announced in early January reductions in troops and closing 63 stores Sam's Club [10], while Britain 's Tesco embarks on a third restructuring [11] in a year. In total they are deleted several tens of thousands of jobs in the distribution sector over recent years between the world's leading distributors. In Belgium, "a new social slaughter" Belgium has not been spared from this restructuring plan. Although no figure concerning some escaped to Belgium in the announcement of Alexandre Bompard, Belgian workers waited nervously fell the news.

On 25 January 2018 the direction of Carrefour Belgium announces that the restructuring plan could cost 1,233 jobs in the country. Accept a difficult announcement given the changes in recent years in the Belgian subsidiary.

Carrefour reaches Belgium through purchase group GB. Then operates 56 hypermarkets, 73 supermarkets and a franchise network. GB has 18,000 workers when Carrfour buy it [12]. At that time GB supermarkets and hypermarkets lose market share in the country. Carrefour, which has better purchasing conditions, get lower prices, invest in its new acquisition and modernizes existing stores, which get positive results from 2003 at the cost of sacrifices of workers in the group who see the new main shareholder denied participation in the benefits from the moment you arrive.

The first strike takes place in 2001 when Carrefour tries to increase flexibility in the group and to limit trade union activities. In 2007 the arrival of new shareholders Colony Capital and Bernard Arnault (which remains the main shareholder) coincides with a first restructuring: 16 franchised supermarkets, 900 resignations (early retirement and voluntary resignations) and new hires to be made as less advantageous joint agreements for workers [13].

It is a first step. In 2010 Carrefour decides a new restructuring concerning 1,700 jobs, provides for the closure of 14 hypermarkets and 7 supermarkets, over all staff to the agreement CP202.01, freeze wages for three years and passage franchise supermarkets 7 [14]. In the beginning of 2018 Carrefour returns to announce the elimination of 1,233 jobs, 180 of them at headquarters. Two supermarkets closed by June 2018 (Liège-Angleur and Genk) while the surface of supermarkets will be reduced and / or will be transformed in supermarkets. As a global scale, the group announces its plan to open trade withdrawal points online and local shops.

Again barely hidden objective: increase the number of franchised stores (with a deteriorating conditions of workers) and extend the opening hours of these shops. The day after the announcement and after the general assemblies organized in stores 27 establishments decided to strike in Hainaut, the province of Liege, Walloon Brabant, the Brussels region and Genk. The SETCa-FGTB union speaks of "a new social slaughter". The government, meanwhile, says it wants to support workers of Carrefour. "It's a complete hypocrisy. If the government wants to do something it must be through legal channels. But if flexible jobs are created not to mourn when 15 days after you lose jobs , "said Delphine Latawiec the CNE

For its part, Marie-Hélène Ska, General Secretary of the CSC, castigates government policies regarding big business: "Carrefour were awarded more than 24 million euros Notional interest

The first strike takes place in 2001 when Carrefour tries to increase flexibility in the group and to limit trade union activities. In 2007 the arrival of new shareholders Colony Capital and Bernard Arnault (which remains the main shareholder) coincides with a first restructuring: 16 franchised supermarkets, 900 resignations (early retirement and voluntary resignations) and new hires to be made as less advantageous joint agreements for workers [13].

It is a first step. In 2010 Carrefour decides a new restructuring concerning 1,700 jobs, provides for the closure of 14 hypermarkets and 7 supermarkets, over all staff to the agreement CP202.01, freeze wages for three years and passage franchise supermarkets 7 [14]. In the beginning of 2018 Carrefour returns to announce the elimination of 1,233 jobs, 180 of them at headquarters. Two supermarkets closed by June 2018 (Liège-Angleur and Genk) while the surface of supermarkets will be reduced and / or will be transformed in supermarkets. As a global scale, the group announces its plan to open trade withdrawal points online and local shops.

Again barely hidden objective: increase the number of franchised stores (with a deteriorating conditions of workers) and extend the opening hours of these shops. The day after the announcement and after the general assemblies organized in stores 27 establishments decided to strike in Hainaut, the province of Liege, Walloon Brabant, the Brussels region and Genk. The SETCa-FGTB union speaks of "a new social slaughter". The government, meanwhile, says it wants to support workers of Carrefour. "It's a complete hypocrisy. If the government wants to do something it must be through legal channels. But if flexible jobs are created not to mourn when 15 days after you lose jobs , "said Delphine Latawiec the CNE

For its part, Marie-Hélène Ska, General Secretary of the CSC, castigates government policies regarding big business: "Carrefour were awarded more than 24 million euros Notional interest

(**) in one year [ ...] ince 16,789 million euros received by Carrefour linked to increases in rates and changes in taxation. At the same time, Carrefour distributed in 2016 is 50 million dividend to its shareholders os. To put it bluntly, the Belgian government has paid dividends to shareholders of Carrefour and Carrefour today, and what has not anticipated anything will do pay Social Security and workers with a reorganization that have nothing to do. It is truly disgusting "[15].

The staff of Carrefour Belgium, which were 18,000 workers at the time of purchase GB, have been disappearing as successive restructurings up to 11,500 (equivalent to 8,500 full - time) before the announcement January 2018 after about 10,000 once the restructuring was made. Myriam Delmee union SETCa, "we are in the same situation as when the last restructuring in 2010. Workers have made efforts, pitched in to what was presented as a bailout and is the situation today." A sect or r foiled

The distribution sector is marked by several underlying trends. The first is the increasingly strong competition from specialty stores and actors of digital as Amazon [16], which increasingly market shares account for all kinds of products, although the sale of food products remains the preserve deprived of the traditional distribution. Traders online tend to propose lower prices thanks to strong logistics processes automation, an organization of "worthy of the nineteenth century" [17] and an offer of more competent delivery work.

The second trend is the rationalization of organizations, seen through the movement of concentration which has been in recent years in the industry, either through mergers and acquisitions, as in the case of Ahold and Delhaize, or in the field of purchasing centers [18]. The minor source of savings and looking in logistics or trade negotiations, as well as the redirection to geographical areas with the greatest potential for growth. Most often this movement rationalization leading to the elimination of jobs.

Carrefour, which has now negotiated the digital change pretty bad obviously has not been spared. However, when announcing the social plan the CEO of Carrefour confirmed its dividend policy: distributing between 45 and 50% of profits. That same day Carrefour shares were up 4% on the stock exchange markets greeted the group policy. Carrefour is a fundamental trend ...

Notes: [1] Lsa-conso.fr, " Format: le gigantisme n'est plus à la mode », 18 October 2001. https://www.lsa-conso.fr/ format-le-gigantisme-n-est-plus-a-la-mode, 70588

[2] Tarteret et Hanne, " Grande distribution et croissance économique in France 'éco DGCCRF, No. 11, December 2012.

[3] On trade negotiations and pressure on purchases, see Wathelet, Violaine, "Les filières of production orchestrées par la Distribution", GRESEA, June 9, 2015, text available in http://www.gresea.be /spip.php?article1385

* in accounting is called equity to the liabilities that are not due to external funding but contributions from the members and the profits generated by the company. Is the sum of equity capital, reserves and income for the year, https://es.wikipedia.org/wiki/Fondos_propios (N. t.)

[4] Lineaires.com, "Comment faire Bompard veut la masse fondre salariale Carrefour ", January 25, 2018. http://www.lineaires.com/LA-DISTRIBUTION/Les-actus/Comment-Bompard-veut-faire-fondre-la-masse-salariale-de-Carrefour-51476

[5] Lineaires.com, "joins Carrefour opens seconde maga plateforme drive ', 8 January 2018. http://www.lineaires.com/LA-DISTRIBUTION/Les-actus/Carrefour-inaugure-une-seconde-mega-plateforme-drive-51404

[6] Romain Gelin "Delhaize & Ahold a mariage de raison '?" GRESEA, April 2015, text available on http://www.mirador-multinationales.be/divers/a-la-une/article/delhaize-ahold- un-mariage de raison

[7] lecho.be, "The restructuration Surprend ne pas chez Cora les syndicats" January 19, 2017. https://www.lecho.be/entreprises/grande-distribution/La- restructuration-chez-Cora-ne-Surprend-pas les syndicats / 9853186

[8] lalibre.be, "Restrucuration chez Makro: aucun licenciement sec" November 9, 2016. http://www.lalibre.be/actu/belgique/restructuration-chez-makro-aucun-licenciement-sec-malgre -505-Pertes-d-emploi-5823301dcd70fb896a674c15

[9] lsa-conso.fr, "L'emploi, sensitive restructuration du plan d'Auchan volet" March 3, 2017. https: //www.lsa-conso .fr / l-emploi- volet-sensitive du plan de restructuration-d-auchan, 255,474

[10] https://www.bloomberg.com/news/articles/2018-01-12/wal-mart -said-to-restructure-store-role-to-business-streamline

[11] https://www.theguardian.com/business/2017/jan/09/tesco-1000-jobs-restructuring-plans ; https://www.theguardian.com/business/2017/jun/28/tesco-to-cut-1200-head-office-jobs ; https://www.express.co.uk/finance/city/908220/tesco-cuts-jobs-results-profits

[12] Lesoir.be, "Distribution. L'intégration de l'enseigne Belge dans lui semble a priori Carrefour profiter "April 12, 2003. http://www.lesoir.be/archive/recup/%25252Fserie-2-distributionl-integration-de-l- enseigne-Belge-d_t-20030412-Z0N1FE.html

** notional interest: own Belgian tax advantage consisting of calculating fictitiously interest on the equity of a company as if they were considered borrowed capital and deduct the amount obtained from taxable profit (in English notional interests ) (N. t.)

[5] Lineaires.com, "joins Carrefour opens seconde maga plateforme drive ', 8 January 2018. http://www.lineaires.com/LA-DISTRIBUTION/Les-actus/Carrefour-inaugure-une-seconde-mega-plateforme-drive-51404

[6] Romain Gelin "Delhaize & Ahold a mariage de raison '?" GRESEA, April 2015, text available on http://www.mirador-multinationales.be/divers/a-la-une/article/delhaize-ahold- un-mariage de raison

[7] lecho.be, "The restructuration Surprend ne pas chez Cora les syndicats" January 19, 2017. https://www.lecho.be/entreprises/grande-distribution/La- restructuration-chez-Cora-ne-Surprend-pas les syndicats / 9853186

[8] lalibre.be, "Restrucuration chez Makro: aucun licenciement sec" November 9, 2016. http://www.lalibre.be/actu/belgique/restructuration-chez-makro-aucun-licenciement-sec-malgre -505-Pertes-d-emploi-5823301dcd70fb896a674c15

[9] lsa-conso.fr, "L'emploi, sensitive restructuration du plan d'Auchan volet" March 3, 2017. https: //www.lsa-conso .fr / l-emploi- volet-sensitive du plan de restructuration-d-auchan, 255,474

[10] https://www.bloomberg.com/news/articles/2018-01-12/wal-mart -said-to-restructure-store-role-to-business-streamline

[11] https://www.theguardian.com/business/2017/jan/09/tesco-1000-jobs-restructuring-plans ; https://www.theguardian.com/business/2017/jun/28/tesco-to-cut-1200-head-office-jobs ; https://www.express.co.uk/finance/city/908220/tesco-cuts-jobs-results-profits

[12] Lesoir.be, "Distribution. L'intégration de l'enseigne Belge dans lui semble a priori Carrefour profiter "April 12, 2003. http://www.lesoir.be/archive/recup/%25252Fserie-2-distributionl-integration-de-l- enseigne-Belge-d_t-20030412-Z0N1FE.html

** notional interest: own Belgian tax advantage consisting of calculating fictitiously interest on the equity of a company as if they were considered borrowed capital and deduct the amount obtained from taxable profit (in English notional interests ) (N. t.)

[15] https://www.rtbf.be/info/belgique/detail_marie-helene-ska-csc-les-syndicats-ne-sont-pas-la-juste-pour-tenir-le-couvercle-sur-une-marmite- Prete-a-exploser-socialement id = 9823244?

[16] See Amazon history compiled by par Gilles t'SERSTEVENS Mirador: http://www.mirador-multinationales.be/secteurs/distribution/article/amazon#histoire

[17] Jean-Baptiste Malet, "In Amazonie, infiltré dans le meilleur des mondes", Fayard, 2013 and Lemonde.fr of December 17, 2013 http://www.lemonde.fr/economie/article/2013/12 /16/les-travailleurs-chez-amazon-ont-des-conditions-de-travail-dignes-du-xixe-siecle_3517609_3234.html

[18] Gelin, Romain, "Distribution: Concentration dans les stations européennes d'achats" GRESEA, September 2015, available in text http://www.gresea.be/spip.php?article1423

Source: http://www.mirador-multinationales.be/analyses/article/carrefour-l-echec-d-un-modele

[16] See Amazon history compiled by par Gilles t'SERSTEVENS Mirador: http://www.mirador-multinationales.be/secteurs/distribution/article/amazon#histoire

[17] Jean-Baptiste Malet, "In Amazonie, infiltré dans le meilleur des mondes", Fayard, 2013 and Lemonde.fr of December 17, 2013 http://www.lemonde.fr/economie/article/2013/12 /16/les-travailleurs-chez-amazon-ont-des-conditions-de-travail-dignes-du-xixe-siecle_3517609_3234.html

[18] Gelin, Romain, "Distribution: Concentration dans les stations européennes d'achats" GRESEA, September 2015, available in text http://www.gresea.be/spip.php?article1423

Source: http://www.mirador-multinationales.be/analyses/article/carrefour-l-echec-d-un-modele

This translation may be reprinted as to respect their integrity and mention the author, the translator and Rebellion as a source of translation.

No hay comentarios:

Publicar un comentario

No se admiten comentarios con datos personales como teléfonos, direcciones o publicidad encubierta