In terms of resources who have gold or oil under the ground it should be able to determine geopolitics or the hegemony of a coin, but the military power is also a determining factor in this reshuffling of leadership amid the collapse of the capitalist system.

Many countries seek to take their gold reserves deposited in vaults at the Bank of the Federal Reserve, even more so in 2013 after the bank refused to return the German gold reserves to its respective owner.

Seeing that the world does not want to depend more on their dollars, Washington opts for regional destabilization to lead to any possible rival weak, experts say there is little hope that the US survive the own wave of chaos that has sparked worldwide .

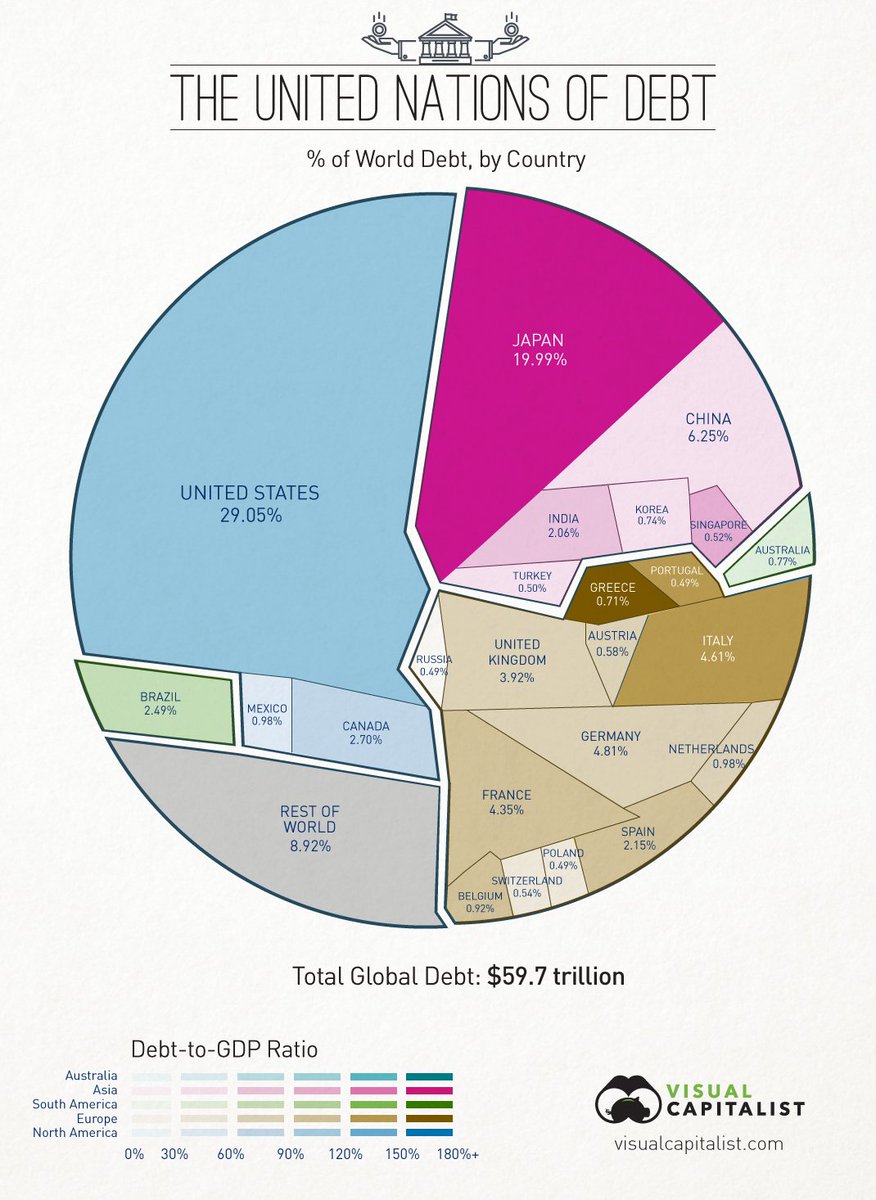

Meanwhile the US debt of nearly 20 trillion dollars is almost as large as that of the 28 members of the European Union and more than what the US produces in a year.

The message gives the Debt-to-GDP ratio gives investors is that the country might have trouble paying what you owe, Obama and Bush emptied state coffers and destroyed the social security funds, among others, financing the "War Terrorism "erogando expenses and other departments

The World According debt of their countries. Via @VisualCap pic.twitter.com/xboxlBDf5l- elOrdenMundial S.XXI (@elOrdenMundial) 24 июля 2017 г.

Even if Russia, in the voice of Prime Minister Dmitry Medvedev has acknowledged that the US has led to an economic scale war , Russian debt is low compared with that of Europe.

Economic growth before 2011 was higher than the US, Germany, France, Japan and other G8 countries.

Putin paid almost the entire foreign debt by selling oil during times of high prices.

Global control mechanisms installed in power wrecked the US relationship - Russia by intrigues and campaigns that ended in a battery of sanctions against the Russian people.

In addition, before the blockades that NATO has made the Russian natural gas through conflicts in Ukraine and Syria, the government of Putin has been able to dodge by the Turkish project South Stream and the imminent defeat of the Islamic State in Syria.

De - dollarization of the Eurasian Union would bring crises to the Western world, especially when Europe is moving around a banking crisis and the US Senate decided to temporarily raise the debt ceiling for US authorities to allocate more than 15,000 million dollars help victims of hurricane Harvey.

On the horizon "futures"

Venezuelan oil market is facing the opportunity of so- called "futures contracts" yuan oil that promotes China.

This type of contract requires the parties to buy or sell an asset at a fixed price determined in advance.

It could become the new standard for those doing the buying and selling of financial instruments in equity markets and could be the newest benchmark for traders to be China's largest oil importer in the world.

According to the Venezuelan vice president also China has shown interest in Venezuelan oil pay in yuan.

Only contracts for West Texas Intermediate (WTI) and Brent traded in the world market for futures and both are valued in US dollars but allow exporters such as Russia, Iran, Qatar and Venezuela to avoid using the dollar because buyers could pay for its oil with yuan or gold after converting the Chinese currency in ounces of the precious metal.

According believes Michael Snyder on his blog portal The Economic Collapse , with the economy and finance Beijing has been playing chess and West checkers, and unfortunately for Washington we have reached the point where checkmate is already on the horizon .

Venezuela takes place in order to preserve their self - determination and sovereignty in peace at a time of geopolitical definitions that will determine the economic course of the world in the coming decades.

Source: Truth Mission

No hay comentarios:

Publicar un comentario

No se admiten comentarios con datos personales como teléfonos, direcciones o publicidad encubierta