After vowing over the weekend to "never surrender to external pressure", Beijing has defied President Trump's demands that it not resort to retaliatory tariffs and announced plans to slap new levies on $60 billion in US goods.

- CHINA SAYS TO RAISE TARIFFS ON SOME U.S. GOODS FROM JUNE 1

- CHINA SAYS TO RAISE TARIFFS ON $60B OF U.S. GOODS

- CHINA SAYS TO RAISE TARIFFS ON 2493 U.S. GOODS TO 25%

- CHINA MAY STOP PURCHASING US AGRICULTURAL PRODUCTS:GLOBAL TIMES

- CHINA MAY REDUCE BOEING ORDERS: GLOBAL TIMES

- CHINA ADDITIONAL TARIFFS DO NOT INCLUDE U.S. CRUDE OIL

- CHINA RAISES TARIFF ON U.S. LNG TO 25% EFFECTIVE JUNE 1

- CHINA TO RAISE TARIFFS ON IMPORTS OF U.S. RARE EARTHS TO 25%

China's announcement comes after the White House raised tariffs on some $200 billion in Chinese goods to 25% from 10% on Friday (however, the new rates will only apply to goods leaving Chinese ports on or after the date where the new tariffs took effect).

Here's a breakdown of how China will impose tariffs on 2,493 US goods. The new rates will take effect at the beginning of next month.

- 2,493 items to be subjected to 25% tariffs.

- 1,078 items to be subject to 20% of tariffs

- 974 items subject to 10% of tariffs

- 595 items continue to be levied at 5% tariffs

In further bad news for American farmers, China might stop purchasing agricultural products from the US, reduce its orders for Boeing planes and restrict service trade.

There has also been talk that the PBOC could start dumping Treasurys (which would, in addition to pushing US rates higher, could also have the effect of strengthening the yuan). Though if China is going to dump Treasuries, will they also be dumping US stocks and real estate?

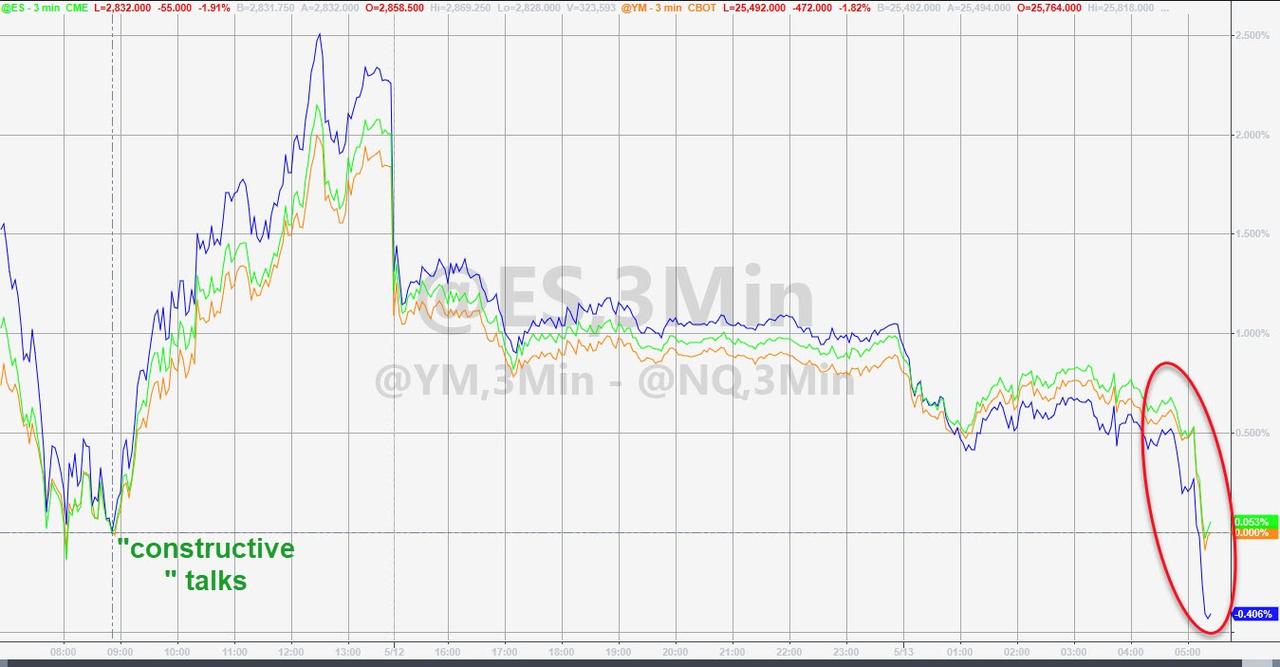

Stocks have now erased the entirety of the "constructive talks" ramp from Friday afternoon.

The yuan, which has been incredibly sensitive to trade-deal news, also crashed on the news.

Gold caught a bid on the trade war escalation.

Reacting to China's threat to dump some Treasuries, 30-year yields headed higher.

Among the most consequential items on China's list is American LNG, which further supports the notion that China is trying to cut off the world's largest energy producer from the world's largest import market. US crude won't be affected by the latest round of tariffs, and the upping of its LNG tariff from 10% to 25% might not have much of an impact seeing as the last batch of tariffs dried up most of the trade.

But the bigger impact, according to Bloomberg, of these tariffs isn't directly trade related. Rather, they serve to discourage Chinese buyers from buying stakes in US export projects, which are extremely capital intensive, according to BBG.

And just like that, with no new deal talks planned and the US preparing to unveil its own next steps to impose 25% tariffs on all Chinese goods entering the American market later in the day, it appears the year-long trade war between the US and China is finally about to go nuclear.

At least that's how it's looking right now: We imagine it's only a matter of time before the US announces the timing of the next round of talks, prompting algos to send the market 500 points higher in a frenzy of buying.

Read MOFCOM's statement announcing the tariff plans below:

On May 9, the US government announced that since May 10, 2019, the tariff rate imposed on the $200 billion list of goods imported from China has been increased from 10% to 25%. The above measures by the United States have led to an escalation of Sino-US economic and trade frictions, contrary to the consensus between China and the United States on resolving trade differences through consultations, jeopardizing the interests of both sides and not meeting the general expectations of the international community.

According to the "People's Republic of China Foreign Trade Law," "People's Republic of China Import and Export Tariff Regulations" and other laws and regulations and the basic principles of international law, the State Council Tariff Commission decided that since 0:00 on June 1, 2019, the part originating in the United States Imported goods will increase the tariff rate. The relevant matters are hereby announced as follows:

1. To increase the tariff rate of some of the commodities in the "Notice of the Customs Tariff Commission of the State Council on the Implementation of Customs Duty on Imports of About US$60 Billion of Imported Goods from the United States" (No. 8 of the Taxation Commission [2018]), in accordance with The State Council Customs Tariff Commission's Circular on the Notification of Adding Tariffs to Certain Imported Commodities Originating in the United States (Second Batch) (TAC Announcement [2018] No. 6) is implemented at the tax rate.

Namely: 2,493 tax items listed in Annex 1 shall be subject to a 25% tariff; for 1078 items of tax items listed in Annex 2, a 20% tariff shall be imposed; and 974 items of tax items listed in Annex 3 shall be imposed. A 10% tariff is imposed. For the 595 items of tax items listed in Annex 4, a 5% tariff is still imposed.

Other matters shall be implemented in accordance with the Notice of the Taxation Committee [2018] No. 6. Attachment:

1. Implement a 25% tariff list for the US

2. Implement a 20% tariff list for the US

3. Implement a 10% tariff list for the US

4. Implementing a list of 5% tariff items for the United States

Published by EVERTH THENANSHED, 1st Official of the Galactic Federation of free planets.

Copyright © misteri1963 All rights reserved.You can copy and distribute this article as long as you do not modify it in any way, the content remains complete, the author is given credit and the URL is included in https://misteri1963.blogspot.com and the Copyright Notice