The "hole" Banking: more than 476,000 million euros

![no-we-no-pay [1]](https://ataquealpoder.files.wordpress.com/2013/06/no-debemos-no-pagamos1.jpg?w=300&h=150) Nobody tells the truth, the Spanish banks are virtually bankrupt. Hole banks seems unfathomable and hidden behind some liars balance sheets, the real situation: a scandalous insolvency scare the most painted. Something will have to see the share price of banks is on the floor. To reach this situation all possible fatal mistakes were made. The goal of banks and Spanish savings banks was expansion at all costs trying to be bigger than your competitors what caused the lack of control and the financial bubble. They were all out , once they emptied depositors accounts with other banks borrowed foreign investment funds and short - term, three or four years, while they are offering mortgage loans to 20 or 30 years and financing to large companies who wanted to conquer the world with borrowed money. The mad race ended in disaster we all know with the aggravating circumstance that the country has run out of credit dragging thousands of companies into the abyss. The "hole" of the banks, so far, is 476,000 million euros to which must be added the arrears to be skyrocketing and contains with refinancing to save time. The debt of Spanish banks with their foreign counterparts, especially German and French is between 425,000 and 500,000 million euros in mortgage bonds. The cycle of granting mortgages, package them and sell them transformed into mortgage bonds to other banks and start all ended abruptly: liquid money ended up buried in billets, houses that no one could buy, industrial buildings destined to saturated million industry problems and suddenly they found no credit and little capital. Thousands of companies caught on the wrong foot slide his disappearance while continuing credit tap closed as banks treat their debt so they no longer fulfill the role they have entrusted in the financial system first. How long will this last? Or more specifically, how much should the banks, how much is your "hole"? Officially there is no figure so I took several weeks collecting data here and there in a kind of old account amounting to 476,000 million euros mentioned. houses that no one could buy, industrial buildings destined to saturated million industry problems and suddenly found themselves without credit and with little social capital. Thousands of companies caught on the wrong foot slide his disappearance while continuing credit tap closed as banks treat their debt so they no longer fulfill the role they have entrusted in the financial system first. How long will this last? Or more specifically, how much should the banks, how much is your "hole"? Officially there is no figure so I took several weeks collecting data here and there in a kind of old account amounting to 476,000 million euros mentioned. houses that no one could buy, industrial buildings destined to saturated million industry problems and suddenly found themselves without credit and with little social capital. Thousands of companies caught on the wrong foot slide his disappearance while continuing credit tap closed as banks treat their debt so they no longer fulfill the role they have entrusted in the financial system first. How long will this last? Or more specifically, how much should the banks, how much is your "hole"? Officially there is no figure so I took several weeks collecting data here and there in a kind of old account amounting to 476,000 million euros mentioned. industrial buildings destined to saturated million industry problems and suddenly found themselves without credit and with little social capital. Thousands of companies caught on the wrong foot slide his disappearance while continuing credit tap closed as banks treat their debt so they no longer fulfill the role they have entrusted in the financial system first. How long will this last? Or more specifically, how much should the banks, how much is your "hole"? Officially there is no figure so I took several weeks collecting data here and there in a kind of old account amounting to 476,000 million euros mentioned. industrial buildings destined to saturated million industry problems and suddenly found themselves without credit and with little social capital. Thousands of companies caught on the wrong foot slide his disappearance while continuing credit tap closed as banks treat their debt so they no longer fulfill the role they have entrusted in the financial system first. How long will this last? Or more specifically, how much should the banks, how much is your "hole"? Officially there is no figure so I took several weeks collecting data here and there in a kind of old account amounting to 476,000 million euros mentioned. Thousands of companies caught on the wrong foot slide his disappearance while continuing credit tap closed as banks treat their debt so they no longer fulfill the role they have entrusted in the financial system first. How long will this last? Or more specifically, how much should the banks, how much is your "hole"? Officially there is no figure so I took several weeks collecting data here and there in a kind of old account amounting to 476,000 million euros mentioned. Thousands of companies caught on the wrong foot slide his disappearance while continuing credit tap closed as banks treat their debt so they no longer fulfill the role they have entrusted in the financial system first. How long will this last? Or more specifically, how much should the banks, how much is your "hole"? Officially there is no figure so I took several weeks collecting data here and there in a kind of old account amounting to 476,000 million euros mentioned. How long will this last? Or more specifically, how much should the banks, how much is your "hole"? Officially there is no figure so I took several weeks collecting data here and there in a kind of old account amounting to 476,000 million euros mentioned. How long will this last? Or more specifically, how much should the banks, how much is your "hole"? Officially there is no figure so I took several weeks collecting data here and there in a kind of old account amounting to 476,000 million euros mentioned.

Nobody tells the truth, the Spanish banks are virtually bankrupt. Hole banks seems unfathomable and hidden behind some liars balance sheets, the real situation: a scandalous insolvency scare the most painted. Something will have to see the share price of banks is on the floor. To reach this situation all possible fatal mistakes were made. The goal of banks and Spanish savings banks was expansion at all costs trying to be bigger than your competitors what caused the lack of control and the financial bubble. They were all out , once they emptied depositors accounts with other banks borrowed foreign investment funds and short - term, three or four years, while they are offering mortgage loans to 20 or 30 years and financing to large companies who wanted to conquer the world with borrowed money. The mad race ended in disaster we all know with the aggravating circumstance that the country has run out of credit dragging thousands of companies into the abyss. The "hole" of the banks, so far, is 476,000 million euros to which must be added the arrears to be skyrocketing and contains with refinancing to save time. The debt of Spanish banks with their foreign counterparts, especially German and French is between 425,000 and 500,000 million euros in mortgage bonds. The cycle of granting mortgages, package them and sell them transformed into mortgage bonds to other banks and start all ended abruptly: liquid money ended up buried in billets, houses that no one could buy, industrial buildings destined to saturated million industry problems and suddenly they found no credit and little capital. Thousands of companies caught on the wrong foot slide his disappearance while continuing credit tap closed as banks treat their debt so they no longer fulfill the role they have entrusted in the financial system first. How long will this last? Or more specifically, how much should the banks, how much is your "hole"? Officially there is no figure so I took several weeks collecting data here and there in a kind of old account amounting to 476,000 million euros mentioned. houses that no one could buy, industrial buildings destined to saturated million industry problems and suddenly found themselves without credit and with little social capital. Thousands of companies caught on the wrong foot slide his disappearance while continuing credit tap closed as banks treat their debt so they no longer fulfill the role they have entrusted in the financial system first. How long will this last? Or more specifically, how much should the banks, how much is your "hole"? Officially there is no figure so I took several weeks collecting data here and there in a kind of old account amounting to 476,000 million euros mentioned. houses that no one could buy, industrial buildings destined to saturated million industry problems and suddenly found themselves without credit and with little social capital. Thousands of companies caught on the wrong foot slide his disappearance while continuing credit tap closed as banks treat their debt so they no longer fulfill the role they have entrusted in the financial system first. How long will this last? Or more specifically, how much should the banks, how much is your "hole"? Officially there is no figure so I took several weeks collecting data here and there in a kind of old account amounting to 476,000 million euros mentioned. industrial buildings destined to saturated million industry problems and suddenly found themselves without credit and with little social capital. Thousands of companies caught on the wrong foot slide his disappearance while continuing credit tap closed as banks treat their debt so they no longer fulfill the role they have entrusted in the financial system first. How long will this last? Or more specifically, how much should the banks, how much is your "hole"? Officially there is no figure so I took several weeks collecting data here and there in a kind of old account amounting to 476,000 million euros mentioned. industrial buildings destined to saturated million industry problems and suddenly found themselves without credit and with little social capital. Thousands of companies caught on the wrong foot slide his disappearance while continuing credit tap closed as banks treat their debt so they no longer fulfill the role they have entrusted in the financial system first. How long will this last? Or more specifically, how much should the banks, how much is your "hole"? Officially there is no figure so I took several weeks collecting data here and there in a kind of old account amounting to 476,000 million euros mentioned. Thousands of companies caught on the wrong foot slide his disappearance while continuing credit tap closed as banks treat their debt so they no longer fulfill the role they have entrusted in the financial system first. How long will this last? Or more specifically, how much should the banks, how much is your "hole"? Officially there is no figure so I took several weeks collecting data here and there in a kind of old account amounting to 476,000 million euros mentioned. Thousands of companies caught on the wrong foot slide his disappearance while continuing credit tap closed as banks treat their debt so they no longer fulfill the role they have entrusted in the financial system first. How long will this last? Or more specifically, how much should the banks, how much is your "hole"? Officially there is no figure so I took several weeks collecting data here and there in a kind of old account amounting to 476,000 million euros mentioned. How long will this last? Or more specifically, how much should the banks, how much is your "hole"? Officially there is no figure so I took several weeks collecting data here and there in a kind of old account amounting to 476,000 million euros mentioned. How long will this last? Or more specifically, how much should the banks, how much is your "hole"? Officially there is no figure so I took several weeks collecting data here and there in a kind of old account amounting to 476,000 million euros mentioned. Very bad must be the subject of money the Fund for Orderly Bank Restructuring (FROB) when he delivers the goods valued banks does in complete secrecy. FROB president Javier Arístegui (also Deputy Governor of the Bank of Spain) appears every three months before a congressional subcommittee, but it does behind closed doors . The money comes from public funds but the parliamentary majority of the Popular Party makes secret question What mystery try to hide? How much is the bill that we endorse the government? We transferred a debt that is not for us plus we hide their total amount that distributed by various way to give us the slip and lie in whatever they pleased. Now, in the best way possible, the morterada that endiñan us. La Grande Bouffe of public funds is not expected and in 2009 begins with the appetizer of the contributions made by the FROB. money through the European Stability Mechanism to recapitalize financial institutions (ESM), money that the state must repay under the embargoed WARNING This being served among the starters. To all this must be added the guarantees provided by the State Market funders to ensure collection. Also it seeped into agreements award Scheme Asset Protection (EPA) (eg BBVA he stayed with Unnim and you are guaranteed that the State pays 80% of bad debts that may arise). La Grande Bouffe of public funds is not expected and in 2009 begins with the appetizer of the contributions made by the FROB. money through the European Stability Mechanism to recapitalize financial institutions (ESM), money that the state must repay under the embargoed WARNING This being served among the starters. To all this must be added the guarantees provided by the State Market funders to ensure collection. Also it seeped into agreements award Scheme Asset Protection (EPA) (eg BBVA he stayed with Unnim and you are guaranteed that the State pays 80% of bad debts that may arise). La Grande Bouffe of public funds is not expected and in 2009 begins with the appetizer of the contributions made by the FROB. money through the European Stability Mechanism to recapitalize financial institutions (ESM), money that the state must repay under the embargoed WARNING This being served among the starters. To all this must be added the guarantees provided by the State Market funders to ensure collection. Also it seeped into agreements award Scheme Asset Protection (EPA) (eg BBVA he stayed with Unnim and you are guaranteed that the State pays 80% of bad debts that may arise). money through the European Stability Mechanism to recapitalize financial institutions (ESM), money that the state must repay under the embargoed WARNING This being served among the starters. To all this must be added the guarantees provided by the State Market funders to ensure collection. Also it seeped into agreements award Scheme Asset Protection (EPA) (eg BBVA he stayed with Unnim and you are guaranteed that the State pays 80% of bad debts that may arise). money through the European Stability Mechanism to recapitalize financial institutions (ESM), money that the state must repay under the embargoed WARNING This being served among the starters. To all this must be added the guarantees provided by the State Market funders to ensure collection. Also it seeped into agreements award Scheme Asset Protection (EPA) (eg BBVA he stayed with Unnim and you are guaranteed that the State pays 80% of bad debts that may arise).

Very bad must be the subject of money the Fund for Orderly Bank Restructuring (FROB) when he delivers the goods valued banks does in complete secrecy. FROB president Javier Arístegui (also Deputy Governor of the Bank of Spain) appears every three months before a congressional subcommittee, but it does behind closed doors . The money comes from public funds but the parliamentary majority of the Popular Party makes secret question What mystery try to hide? How much is the bill that we endorse the government? We transferred a debt that is not for us plus we hide their total amount that distributed by various way to give us the slip and lie in whatever they pleased. Now, in the best way possible, the morterada that endiñan us. La Grande Bouffe of public funds is not expected and in 2009 begins with the appetizer of the contributions made by the FROB. money through the European Stability Mechanism to recapitalize financial institutions (ESM), money that the state must repay under the embargoed WARNING This being served among the starters. To all this must be added the guarantees provided by the State Market funders to ensure collection. Also it seeped into agreements award Scheme Asset Protection (EPA) (eg BBVA he stayed with Unnim and you are guaranteed that the State pays 80% of bad debts that may arise). La Grande Bouffe of public funds is not expected and in 2009 begins with the appetizer of the contributions made by the FROB. money through the European Stability Mechanism to recapitalize financial institutions (ESM), money that the state must repay under the embargoed WARNING This being served among the starters. To all this must be added the guarantees provided by the State Market funders to ensure collection. Also it seeped into agreements award Scheme Asset Protection (EPA) (eg BBVA he stayed with Unnim and you are guaranteed that the State pays 80% of bad debts that may arise). La Grande Bouffe of public funds is not expected and in 2009 begins with the appetizer of the contributions made by the FROB. money through the European Stability Mechanism to recapitalize financial institutions (ESM), money that the state must repay under the embargoed WARNING This being served among the starters. To all this must be added the guarantees provided by the State Market funders to ensure collection. Also it seeped into agreements award Scheme Asset Protection (EPA) (eg BBVA he stayed with Unnim and you are guaranteed that the State pays 80% of bad debts that may arise). money through the European Stability Mechanism to recapitalize financial institutions (ESM), money that the state must repay under the embargoed WARNING This being served among the starters. To all this must be added the guarantees provided by the State Market funders to ensure collection. Also it seeped into agreements award Scheme Asset Protection (EPA) (eg BBVA he stayed with Unnim and you are guaranteed that the State pays 80% of bad debts that may arise). money through the European Stability Mechanism to recapitalize financial institutions (ESM), money that the state must repay under the embargoed WARNING This being served among the starters. To all this must be added the guarantees provided by the State Market funders to ensure collection. Also it seeped into agreements award Scheme Asset Protection (EPA) (eg BBVA he stayed with Unnim and you are guaranteed that the State pays 80% of bad debts that may arise).![644511_444289302274122_1023938890_n [1]](https://ataquealpoder.files.wordpress.com/2013/06/644511_444289302274122_1023938890_n1.jpg?w=212&h=300) Not just here millonada given to banks in exchange for nothing, to establish a perverse circuit in buying real estate assets difficult to sell and placed in the bad bank in a waste of public funds. So far we could add different lines: 1) FROB, 2) ESM, 3) State guarantees, 4) bad bank known for Sareb, and 5) EPA, 6) Guarantee Fund deposits, but to determine the "hole" we must add the heist 7) of preferred and subordinated debt product con savers no less than 40,000 million euros and debt 8) have banks with the European Central Bank to muddle through amounting to 107,480 million euros. In addition, all these external routes must be added 149. 000 million euros that large banks have 9) accrued between 2008 and 2012. The first seven funding streams clogged, so far, the hole in the bank. The last two (8 and 9) are private debt does not affect public funds, but it serves to determine the "hole" of banking. The "moment" may be a few weeks or months but I can anticipate that it is preparing a corralito (is not no invention, no documents of the European Union that deal explicitly that bank deposits should contribute to cover the " hole "of banks. I put in brackets and make sure not to alarm completely in addition to publishing). Consider now the cheerful waste bank bank. the hole in the bank. The last two (8 and 9) are private debt does not affect public funds, but it serves to determine the "hole" of banking. The "moment" may be a few weeks or months but I can anticipate that it is preparing a corralito (is not no invention, no documents of the European Union that deal explicitly that bank deposits should contribute to cover the " hole "of banks. I put in brackets and make sure not to alarm completely in addition to publishing). Consider now the cheerful waste bank bank. the hole in the bank. The last two (8 and 9) are private debt does not affect public funds, but it serves to determine the "hole" of banking. The "moment" may be a few weeks or months but I can anticipate that it is preparing a corralito (is not no invention, no documents of the European Union that deal explicitly that bank deposits should contribute to cover the " hole "of banks. I put in brackets and make sure not to alarm completely in addition to publishing). Consider now the cheerful waste bank bank. The "moment" may be a few weeks or months but I can anticipate that it is preparing a corralito (is not no invention, no documents of the European Union that deal explicitly that bank deposits should contribute to cover the " hole "of banks. I put in brackets and make sure not to alarm completely in addition to publishing). Consider now the cheerful waste bank bank. The "moment" may be a few weeks or months but I can anticipate that it is preparing a corralito (is not no invention, no documents of the European Union that deal explicitly that bank deposits should contribute to cover the " hole "of banks. I put in brackets and make sure not to alarm completely in addition to publishing). Consider now the cheerful waste bank bank.

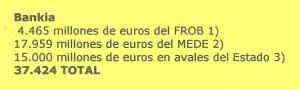

Not just here millonada given to banks in exchange for nothing, to establish a perverse circuit in buying real estate assets difficult to sell and placed in the bad bank in a waste of public funds. So far we could add different lines: 1) FROB, 2) ESM, 3) State guarantees, 4) bad bank known for Sareb, and 5) EPA, 6) Guarantee Fund deposits, but to determine the "hole" we must add the heist 7) of preferred and subordinated debt product con savers no less than 40,000 million euros and debt 8) have banks with the European Central Bank to muddle through amounting to 107,480 million euros. In addition, all these external routes must be added 149. 000 million euros that large banks have 9) accrued between 2008 and 2012. The first seven funding streams clogged, so far, the hole in the bank. The last two (8 and 9) are private debt does not affect public funds, but it serves to determine the "hole" of banking. The "moment" may be a few weeks or months but I can anticipate that it is preparing a corralito (is not no invention, no documents of the European Union that deal explicitly that bank deposits should contribute to cover the " hole "of banks. I put in brackets and make sure not to alarm completely in addition to publishing). Consider now the cheerful waste bank bank. the hole in the bank. The last two (8 and 9) are private debt does not affect public funds, but it serves to determine the "hole" of banking. The "moment" may be a few weeks or months but I can anticipate that it is preparing a corralito (is not no invention, no documents of the European Union that deal explicitly that bank deposits should contribute to cover the " hole "of banks. I put in brackets and make sure not to alarm completely in addition to publishing). Consider now the cheerful waste bank bank. the hole in the bank. The last two (8 and 9) are private debt does not affect public funds, but it serves to determine the "hole" of banking. The "moment" may be a few weeks or months but I can anticipate that it is preparing a corralito (is not no invention, no documents of the European Union that deal explicitly that bank deposits should contribute to cover the " hole "of banks. I put in brackets and make sure not to alarm completely in addition to publishing). Consider now the cheerful waste bank bank. The "moment" may be a few weeks or months but I can anticipate that it is preparing a corralito (is not no invention, no documents of the European Union that deal explicitly that bank deposits should contribute to cover the " hole "of banks. I put in brackets and make sure not to alarm completely in addition to publishing). Consider now the cheerful waste bank bank. The "moment" may be a few weeks or months but I can anticipate that it is preparing a corralito (is not no invention, no documents of the European Union that deal explicitly that bank deposits should contribute to cover the " hole "of banks. I put in brackets and make sure not to alarm completely in addition to publishing). Consider now the cheerful waste bank bank. Birds of a feather flock together, in June 2010 merged Caja Madrid, Bancaja, Caja Avila, Caja Segovia, Caja Rioja, Caixa Laietana and Caja Insular de Canarias, forming Bankia. Savings boxes full of political seated on the board of directors misled shareholders by giving them for a ride and tried to redeem their sins once took fraudulently Bankia initial public offering. Today the shares are worthless after several ducts 1) FROB, 2) ESM and 3) government guarantees were snacked 37,424 million euros . Miguel Blesa as president of Caja Madrid, Rodrigo Rato as chairman of Bankia are on a tightrope.

Birds of a feather flock together, in June 2010 merged Caja Madrid, Bancaja, Caja Avila, Caja Segovia, Caja Rioja, Caixa Laietana and Caja Insular de Canarias, forming Bankia. Savings boxes full of political seated on the board of directors misled shareholders by giving them for a ride and tried to redeem their sins once took fraudulently Bankia initial public offering. Today the shares are worthless after several ducts 1) FROB, 2) ESM and 3) government guarantees were snacked 37,424 million euros . Miguel Blesa as president of Caja Madrid, Rodrigo Rato as chairman of Bankia are on a tightrope.

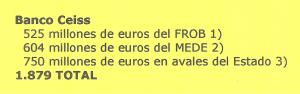

Catalunyacaixa, is the result of the merger of Caixa Catalunya, Caixa Tarragona and Caixa Manresa in December 2009. It has had to be aided by 1) FROB, 2) and 3 ESM State guarantees, the "hole" is such a dimension that has not found anyone to welcome him into  their midst. Banco Santander round unfinished decide. Socialist and Vice President Narcis Serra presided Caixa Catalunya without fucking idea what a bank, apparently his is playing the piano. Banc Caixa moment takes swallowed up 17,293 million euros and we continue to bingo.

their midst. Banco Santander round unfinished decide. Socialist and Vice President Narcis Serra presided Caixa Catalunya without fucking idea what a bank, apparently his is playing the piano. Banc Caixa moment takes swallowed up 17,293 million euros and we continue to bingo.

their midst. Banco Santander round unfinished decide. Socialist and Vice President Narcis Serra presided Caixa Catalunya without fucking idea what a bank, apparently his is playing the piano. Banc Caixa moment takes swallowed up 17,293 million euros and we continue to bingo.

their midst. Banco Santander round unfinished decide. Socialist and Vice President Narcis Serra presided Caixa Catalunya without fucking idea what a bank, apparently his is playing the piano. Banc Caixa moment takes swallowed up 17,293 million euros and we continue to bingo.

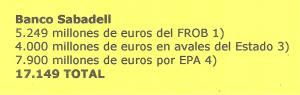

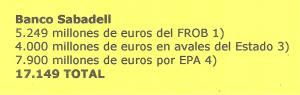

In December 2011 the FROB awarded the Caja de Ahorros del Mediterráneo (CAM) to Banco Sabadell for one euro . CAM had been taken over by the FROB and had received 5,249 million euros to the astonishment came from the Deposit Guarantee Fund. In addition, the State endorsed the CAM with 4,000 million in 2012 and, last but not least,  it received aid in the form of Scheme Asset Protection (EPA) covering 80% of losses after provisions, ie, is guaranteed Banco Sabadell delinquencies that may arise once awarded the CAM. This aid can reach up to 7. 900 million euros will also be subtracted from the Deposit Guarantee Fund in theory serves to guarantee deposits of bank customers from the fund this operation run out of a sad euro. In total , the Banco de Sabadell have fallen from the sky 17,149 million euros to which must be added a loan amounting to 8,000 million euros with the European Central Bank.

it received aid in the form of Scheme Asset Protection (EPA) covering 80% of losses after provisions, ie, is guaranteed Banco Sabadell delinquencies that may arise once awarded the CAM. This aid can reach up to 7. 900 million euros will also be subtracted from the Deposit Guarantee Fund in theory serves to guarantee deposits of bank customers from the fund this operation run out of a sad euro. In total , the Banco de Sabadell have fallen from the sky 17,149 million euros to which must be added a loan amounting to 8,000 million euros with the European Central Bank.

it received aid in the form of Scheme Asset Protection (EPA) covering 80% of losses after provisions, ie, is guaranteed Banco Sabadell delinquencies that may arise once awarded the CAM. This aid can reach up to 7. 900 million euros will also be subtracted from the Deposit Guarantee Fund in theory serves to guarantee deposits of bank customers from the fund this operation run out of a sad euro. In total , the Banco de Sabadell have fallen from the sky 17,149 million euros to which must be added a loan amounting to 8,000 million euros with the European Central Bank.

it received aid in the form of Scheme Asset Protection (EPA) covering 80% of losses after provisions, ie, is guaranteed Banco Sabadell delinquencies that may arise once awarded the CAM. This aid can reach up to 7. 900 million euros will also be subtracted from the Deposit Guarantee Fund in theory serves to guarantee deposits of bank customers from the fund this operation run out of a sad euro. In total , the Banco de Sabadell have fallen from the sky 17,149 million euros to which must be added a loan amounting to 8,000 million euros with the European Central Bank.

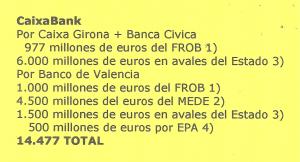

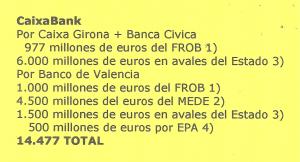

The Caixa absorbed Caixa Girona to become Caixabank, then made with Civic Banking, the entity formed by the merger of Caja Navarra, CajaCanarias, Caja Burgos, Cajasol and Caja  Guadalajara. Later, in December 2012 . the FROB awarded CaixaBank the Banco de Valencia , which was operated by the Bank of Spain in 2011, and alone has been 7.500 million euros, half of the generous aid to CaixaBank amounting to 14,477 million euros. Although CaixaBank is awarded the label "healthy banking" (that's saying something ) it has had to resort to a loan of 18,480 million euros with the European Central Bank. Not all that glitters is gold.

Guadalajara. Later, in December 2012 . the FROB awarded CaixaBank the Banco de Valencia , which was operated by the Bank of Spain in 2011, and alone has been 7.500 million euros, half of the generous aid to CaixaBank amounting to 14,477 million euros. Although CaixaBank is awarded the label "healthy banking" (that's saying something ) it has had to resort to a loan of 18,480 million euros with the European Central Bank. Not all that glitters is gold.

Guadalajara. Later, in December 2012 . the FROB awarded CaixaBank the Banco de Valencia , which was operated by the Bank of Spain in 2011, and alone has been 7.500 million euros, half of the generous aid to CaixaBank amounting to 14,477 million euros. Although CaixaBank is awarded the label "healthy banking" (that's saying something ) it has had to resort to a loan of 18,480 million euros with the European Central Bank. Not all that glitters is gold.

Guadalajara. Later, in December 2012 . the FROB awarded CaixaBank the Banco de Valencia , which was operated by the Bank of Spain in 2011, and alone has been 7.500 million euros, half of the generous aid to CaixaBank amounting to 14,477 million euros. Although CaixaBank is awarded the label "healthy banking" (that's saying something ) it has had to resort to a loan of 18,480 million euros with the European Central Bank. Not all that glitters is gold.

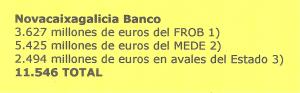

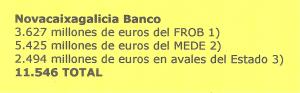

Abanca is the result of the merger between Caixa Galicia and Caixanova. This fully controlled by the FROB and its relief part ESM and has nurtured State guarantees further stressed by l  to placement between small savers rotten product preference shares deceptive techniques. The joke amounted to 11,546 million euros that its size is outrageous.

to placement between small savers rotten product preference shares deceptive techniques. The joke amounted to 11,546 million euros that its size is outrageous.

to placement between small savers rotten product preference shares deceptive techniques. The joke amounted to 11,546 million euros that its size is outrageous.

to placement between small savers rotten product preference shares deceptive techniques. The joke amounted to 11,546 million euros that its size is outrageous.

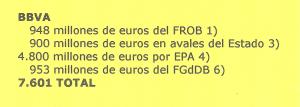

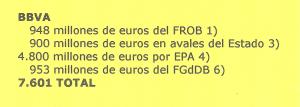

Unnim, controlled by the FROB is the result of the merger of Caixa Sabadell, Caixa Terrassa and Caixa Manlleu and was awarded to BBVA in 2012. Between whistles and flutes BBVA has received 7,601 million euros to  which must be added a loan amount of 22.000 million euros with the European Central Bank which is outrageous to merit the qualification of "healthy banking". There is no escaping the massive sale of preference shares among its customers.

which must be added a loan amount of 22.000 million euros with the European Central Bank which is outrageous to merit the qualification of "healthy banking". There is no escaping the massive sale of preference shares among its customers.

which must be added a loan amount of 22.000 million euros with the European Central Bank which is outrageous to merit the qualification of "healthy banking". There is no escaping the massive sale of preference shares among its customers.

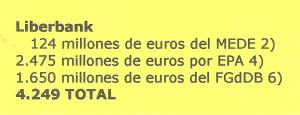

which must be added a loan amount of 22.000 million euros with the European Central Bank which is outrageous to merit the qualification of "healthy banking". There is no escaping the massive sale of preference shares among its customers. Caja Castilla la Mancha was taken over by the Bank of Spain. The restructuring of the entity ended with the integration of Caja Cantabria, Cajastur and Caja Extremadura. The joke has cost 4,249 million euros.

Caja Castilla la Mancha was taken over by the Bank of Spain. The restructuring of the entity ended with the integration of Caja Cantabria, Cajastur and Caja Extremadura. The joke has cost 4,249 million euros. It is resulting from the merger between Caja Spain and Caja Duero, which took place in 2010. When recapitalize, the FROB will become majority shareholder and is responsible for its restructuring and sale. It is in talks with Unicaja.

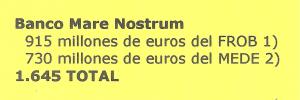

It is resulting from the merger between Caja Spain and Caja Duero, which took place in 2010. When recapitalize, the FROB will become majority shareholder and is responsible for its restructuring and sale. It is in talks with Unicaja. It is the result of the merger of Caja Murcia, Caixa Penedes, Sa Nostra and Caja Granada in 2010. The four boxes act with their own name on a called cold fusion, just the logo is attached to the BMN.

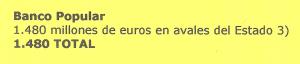

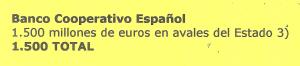

It is the result of the merger of Caja Murcia, Caixa Penedes, Sa Nostra and Caja Granada in 2010. The four boxes act with their own name on a called cold fusion, just the logo is attached to the BMN. Popular has behind Banco Pastor. In fiscal 2012 the Bank has had substantial losses which forced him to a capital and has had to resort to a loan of 14,500 million euros with the European Central Bank.

Popular has behind Banco Pastor. In fiscal 2012 the Bank has had substantial losses which forced him to a capital and has had to resort to a loan of 14,500 million euros with the European Central Bank. It is one of the banks that chest out to belong to the saga of the Botín however has needed public money from a loan amounting to 9,500 million euros with the European Central Bank.

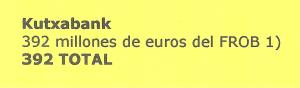

It is one of the banks that chest out to belong to the saga of the Botín however has needed public money from a loan amounting to 9,500 million euros with the European Central Bank. It is the result of the merger between BBK, Cajasur, Caja Vital and Kutxa. CajaSur was seized in 2010 by the Bank of Spain after failing to merge with Unicaja.

It is the result of the merger between BBK, Cajasur, Caja Vital and Kutxa. CajaSur was seized in 2010 by the Bank of Spain after failing to merge with Unicaja.

However macro has needed a loan of 35,000 million euros with the European Central Bank. Santander in any way you want to see on its board of directors anyone representing state institutions and can monitor their accounts constructed lie after lie.

The report Turiel

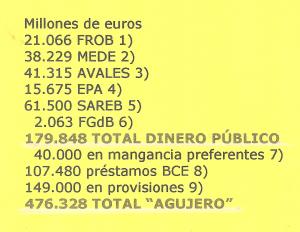

We have seen bank by bank binging that have taken public funds as if we had money left over. Pitch the sum of the different supply routes is the beautiful figure of 179,848 million euros, however it depends on how the numbers are made public money amounting to 222,000 million euros. But to determine the "hole" of banking we have to go other routes of supply: no less than 40,000 million euros stolen from current accounts and fixed - term scam of senior and subordinated 7) subtracted customers. Where between public and stolen da 219.000 million to which must be added 8) 107,480 million in loans from the ECB and 9) 149,000 million euros that major banks have accrued to cover defaulters who go to heaven. The total is 476. 328 million euros amounting to almost half of GDP. The thing must go around in Turiel report see the corruption and odious debt ... Continue reading → signed by Agustín

We have seen bank by bank binging that have taken public funds as if we had money left over. Pitch the sum of the different supply routes is the beautiful figure of 179,848 million euros, however it depends on how the numbers are made public money amounting to 222,000 million euros. But to determine the "hole" of banking we have to go other routes of supply: no less than 40,000 million euros stolen from current accounts and fixed - term scam of senior and subordinated 7) subtracted customers. Where between public and stolen da 219.000 million to which must be added 8) 107,480 million in loans from the ECB and 9) 149,000 million euros that major banks have accrued to cover defaulters who go to heaven. The total is 476. 328 million euros amounting to almost half of GDP. The thing must go around in Turiel report see the corruption and odious debt ... Continue reading → signed by Agustín  Turiel Martínez, inspector of Finance said in a rigorous work that odious debt, which does not correspond to citizens, rises to 120.842 million euros in December 2010 an astronomical figure corresponding to 12% of GDP and there are still, in its report, the years 2011 and 2012. to try to be rigorous I think the figure of 179,848,000 euros that I get to take the amount of money given to banks it falls short. For those who are curious can go to the website of the FROB in the "Staffing and Funding" on the third point reads: "Borrowings obtained by the FROB, whatever the modality of its implementation shall not exceed the limit established for that purpose in the annual laws of the State Budget. The limit set for the year 2012 amounted to 120.000 million euros " . If in a year are allowed the luxury to allocate 120,000 million as a gift for the banks is not surprising that the president of the FROB when appear at the congressional subcommittee do it behind closed doors What a crap democracy and go fuck politicians! If you meet secretly for nothing: to deceive. shall not exceed the limit established for that purpose in the annual laws of the State Budget. The limit set for the year 2012 amounted to 120.000 million euros " . If in a year are allowed the luxury to allocate 120,000 million as a gift for the banks is not surprising that the president of the FROB when appear at the congressional subcommittee do it behind closed doors What a crap democracy and go fuck politicians! If you meet secretly for nothing: to deceive. shall not exceed the limit established for that purpose in the annual laws of the State Budget. The limit set for the year 2012 amounted to 120.000 million euros " . If in a year are allowed the luxury to allocate 120,000 million as a gift for the banks is not surprising that the president of the FROB when appear at the congressional subcommittee do it behind closed doors What a crap democracy and go fuck politicians! If you meet secretly for nothing: to deceive. 000 million as a gift for the banks is not surprising that the president of the FROB when appear at the congressional subcommittee behind closed doors do crap Go democracy and politicians go fuck! If you meet secretly for nothing: to deceive. 000 million as a gift for the banks is not surprising that the president of the FROB when appear at the congressional subcommittee behind closed doors do crap Go democracy and politicians go fuck! If you meet secretly for nothing: to deceive.

Turiel Martínez, inspector of Finance said in a rigorous work that odious debt, which does not correspond to citizens, rises to 120.842 million euros in December 2010 an astronomical figure corresponding to 12% of GDP and there are still, in its report, the years 2011 and 2012. to try to be rigorous I think the figure of 179,848,000 euros that I get to take the amount of money given to banks it falls short. For those who are curious can go to the website of the FROB in the "Staffing and Funding" on the third point reads: "Borrowings obtained by the FROB, whatever the modality of its implementation shall not exceed the limit established for that purpose in the annual laws of the State Budget. The limit set for the year 2012 amounted to 120.000 million euros " . If in a year are allowed the luxury to allocate 120,000 million as a gift for the banks is not surprising that the president of the FROB when appear at the congressional subcommittee do it behind closed doors What a crap democracy and go fuck politicians! If you meet secretly for nothing: to deceive. shall not exceed the limit established for that purpose in the annual laws of the State Budget. The limit set for the year 2012 amounted to 120.000 million euros " . If in a year are allowed the luxury to allocate 120,000 million as a gift for the banks is not surprising that the president of the FROB when appear at the congressional subcommittee do it behind closed doors What a crap democracy and go fuck politicians! If you meet secretly for nothing: to deceive. shall not exceed the limit established for that purpose in the annual laws of the State Budget. The limit set for the year 2012 amounted to 120.000 million euros " . If in a year are allowed the luxury to allocate 120,000 million as a gift for the banks is not surprising that the president of the FROB when appear at the congressional subcommittee do it behind closed doors What a crap democracy and go fuck politicians! If you meet secretly for nothing: to deceive. 000 million as a gift for the banks is not surprising that the president of the FROB when appear at the congressional subcommittee behind closed doors do crap Go democracy and politicians go fuck! If you meet secretly for nothing: to deceive. 000 million as a gift for the banks is not surprising that the president of the FROB when appear at the congressional subcommittee behind closed doors do crap Go democracy and politicians go fuck! If you meet secretly for nothing: to deceive. ![images [1]](https://ataquealpoder.files.wordpress.com/2013/06/images11.jpg?w=150&h=54)

![images [2]](https://ataquealpoder.files.wordpress.com/2013/06/images2.jpg?w=150&h=150)

![images [1] (2)](https://ataquealpoder.files.wordpress.com/2013/06/images1-2.jpg?w=150&h=75)

![images [5]](https://ataquealpoder.files.wordpress.com/2013/06/images5.jpg?w=150&h=109)

![images [4]](https://ataquealpoder.files.wordpress.com/2013/06/images4.jpg?w=150&h=106)

![images [2] (2)](https://ataquealpoder.files.wordpress.com/2013/06/images2-2.jpg?w=150&h=109)

![images [4] (2)](https://ataquealpoder.files.wordpress.com/2013/06/images4-2.jpg?w=150&h=90)

![detalle_bce [1]](https://ataquealpoder.files.wordpress.com/2013/06/detalle_bce1.jpg?w=150&h=99)

![images [5] (2)](https://ataquealpoder.files.wordpress.com/2013/06/images5-2.jpg?w=150&h=72)

![logo-Box3 [1]](https://ataquealpoder.files.wordpress.com/2013/06/logo-caja31.jpg?w=150&h=71)

![images [6] (2)](https://ataquealpoder.files.wordpress.com/2013/06/images6-2.jpg?w=150&h=109)

![bank-santander-logo [1]](https://ataquealpoder.files.wordpress.com/2013/06/banco-santander-logo1.gif?w=150&h=57)

No hay comentarios:

Publicar un comentario

No se admiten comentarios con datos personales como teléfonos, direcciones o publicidad encubierta