The Federals closed the supposedly fraudulent cryptocurrency that offers offers of cryptocurrency is no longer a free zone of regulation.

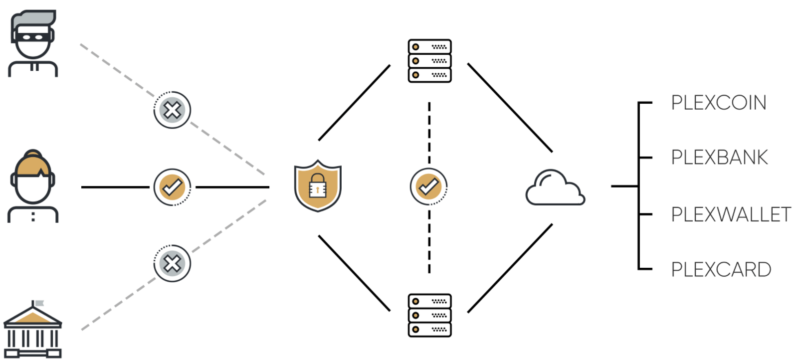

TIMOTHY B. LEE - 4/12/2017, 5:35 PM Enlarge / A diagram on the PlexCoin website illustrates the revolutionary architecture of cryptocurrencies. The Securities and Exchange Commission announced on Monday it was taking action against an initial offer of currencies (ICO) that the SEC alleges is fraudulent. The announcement represents the first enforcement action by the cyber defense unit recently created by the SEC . In recent months, the SEC has been struggling with what to do with ICOs

The US securities laws UU They impose a series of requirements on anyone offering new investments to the public. ICOs, in which a company offers public cryptocurrencies that could appreciate their value in the same way as Bitcoin, are very similar to stock offerings. But most ICOs have ignored the requirements of the SEC. At the same time, the SEC is aware that new cryptocurrencies could become an important source of innovation. And some experts argue that many new cryptocurrencies-those that serve a useful function beyond their potential to grow in value over time-are not values, legally speaking. So, the SEC has proceeded with caution. In July, the agency he fired a warning shot

. He announced that a 2016 fundraising campaign had come into conflict with the securities law, but that the SEC would decline to prosecute those responsible. The hope was to get the world of cryptocurrencies to take the securities laws more seriously without doing anything drastic. Now, the SEC is taking the next step in processing what it considers to be one of the most flagrant scams in the world of the ICO. The SEC's lawsuit, filed in federal court in New York, is against Dominic Lacroix, whom the SEC describes as a "repeat infringer of the securities law." The SEC believes that Lacroix's cryptocurrency project, PlexCoin, is an "initial coin offer fraud (ICO) that generated up to $ 15 million from thousands of investors since August, falsely promising a 13-time gain in less than a month.

The website PlexCoin has a hilariously vague description of this cryptocurrency supposedly revolutionary. "PlexCoin's new revolutionary operating structure is safer and much easier to use than any other current cryptocurrency," the site proclaims. "One of the many features of PlexBank will be to secure its cryptocurrency from market variation, which is highly volatile, and invest its money in a place where it can get interesting guaranteed returns." The company says it is working on a PlexCard to allow people to spend their PlexCoin balances. "Every purchase you make with your PlexCard will guarantee you a perfect interbank exchange rate with no fees," says the site.

The SEC is not impressed and argues that PlexCoin has "all the characteristics of a full-fledged cyber scam". The agency is trying to freeze the assets of the PlexCoin project in the hope of recovering funds from investors. Most ICOs are not direct scams, as alleged by the SEC in this case. Even so, the action will pause many other ICO sponsors. The law of values goes far beyond combating fraud. Offering values to the public without following the rules of the SEC can get people into a lot of trouble. The SEC started with PlexCoin, but its enforcement of securities laws probably does not end there.Source: Ars Technica

The US securities laws UU They impose a series of requirements on anyone offering new investments to the public. ICOs, in which a company offers public cryptocurrencies that could appreciate their value in the same way as Bitcoin, are very similar to stock offerings. But most ICOs have ignored the requirements of the SEC. At the same time, the SEC is aware that new cryptocurrencies could become an important source of innovation. And some experts argue that many new cryptocurrencies-those that serve a useful function beyond their potential to grow in value over time-are not values, legally speaking. So, the SEC has proceeded with caution. In July, the agency he fired a warning shot

. He announced that a 2016 fundraising campaign had come into conflict with the securities law, but that the SEC would decline to prosecute those responsible. The hope was to get the world of cryptocurrencies to take the securities laws more seriously without doing anything drastic. Now, the SEC is taking the next step in processing what it considers to be one of the most flagrant scams in the world of the ICO. The SEC's lawsuit, filed in federal court in New York, is against Dominic Lacroix, whom the SEC describes as a "repeat infringer of the securities law." The SEC believes that Lacroix's cryptocurrency project, PlexCoin, is an "initial coin offer fraud (ICO) that generated up to $ 15 million from thousands of investors since August, falsely promising a 13-time gain in less than a month.

The website PlexCoin has a hilariously vague description of this cryptocurrency supposedly revolutionary. "PlexCoin's new revolutionary operating structure is safer and much easier to use than any other current cryptocurrency," the site proclaims. "One of the many features of PlexBank will be to secure its cryptocurrency from market variation, which is highly volatile, and invest its money in a place where it can get interesting guaranteed returns." The company says it is working on a PlexCard to allow people to spend their PlexCoin balances. "Every purchase you make with your PlexCard will guarantee you a perfect interbank exchange rate with no fees," says the site.

The SEC is not impressed and argues that PlexCoin has "all the characteristics of a full-fledged cyber scam". The agency is trying to freeze the assets of the PlexCoin project in the hope of recovering funds from investors. Most ICOs are not direct scams, as alleged by the SEC in this case. Even so, the action will pause many other ICO sponsors. The law of values goes far beyond combating fraud. Offering values to the public without following the rules of the SEC can get people into a lot of trouble. The SEC started with PlexCoin, but its enforcement of securities laws probably does not end there.Source: Ars Technica

No hay comentarios:

Publicar un comentario

No se admiten comentarios con datos personales como teléfonos, direcciones o publicidad encubierta