*****************************************

Once protected by the logic of the relentless rotation of innovation in Silicon Valley - which dictated that any prevailing technological empire could rule long before following the path of Yahoo and AOL - tech giants like Facebook, Amazon and Google have undergone antitrust increasing pressure - poster Elizabeth Warren "Break up Big Tech" is just the latest example. In fact, the big tech that takes away confidence has become one of the few issues in contemporary Washington to get a genuine bipartisan support.

Since the Trump administration came to power two years ago, despite the opposition of Silicon Valley evening. - as revealed later, the big tech actually conspired with the Clinton campaign to undermine the chances of Trump - and l rate of antitrust scrutiny unprecedented has become stronger each time, Facilitated by suspicions own expressed publicly by the own president.

And on Friday, the dam finally broke.

Just before midnight on Friday, at the end of what was a hectic month for markets, WSJ dropped a bombshell of an article:

The newspaper reported that the Justice Department opened an antitrust investigation Alphabet Inc., which could "make a new and important layer of regulatory control for the search giant, according to people familiar with the matter." The report was based on "people familiar with the matter", but was quickly confirmed by the New York Times, Bloomberg and others.

For months, it seems that the FTC is preparing for a showdown with the big tech. L to agency, which shares antitrust authority with the DoJ has created a new commission that could help break the links of major technologies such as the acquisition of Instagram on Facebook by Facebook. and hired lawyers who have advanced new antitrust theories that would help justify the dissolution of companies like Amazon.

It turns out that the first salvo administration against great technology Trump did not come from the FTC; Instead, this responsibility has been delegated to the Department of Justice, which, reportedly, oversaw the investigation of Google.

That's not very surprising because the FTC hasalready had the opportunity to attack Google with an antitrust investigation in 2013. But the agency fell short. So we can say, it seems that the administration will share responsibility for any future antitrust investigation between the two agencies, which means that the FTC - which is already preparing to impose massive fines against Facebook - could end up taking the lead in these cases.

Although WSJ did not specify what aspects of Google's business could be under the microscope, a series of fines of thousands of millions of euros recently imposed by the EU could offer some guidance. The antitrust authority bloc, which has been much more willing to confront the US tech giants that his US counterpart (for reasons that should be obvious to everyone), has fined Google for its practice of packaged software with its standard license Android, how your search engine rankings promotes its own product listings, and the ways that has harmed competition in the market for digital advertising.

During the height of the controversy over the abuses of big tech confidential data users last year The Verge published a story speculating about how they could beremedied monopolistic tendencies of each of the key technology giants of Silicon Valley. For Google, he argued the Verge , the best remedy would be toprohibit acquisitions, a strategy that has been developed in Congress.

Our best model for technology is the antitrust case against packaging Justice Department against Microsoft in the 90s, which argued that Microsoft was using its control over the PC market to force operating systems and competing browsers. If you are looking for a contemporary equivalent, Google is probably the most appropriate. On a good day, Google (or alphabet, if you prefer) is the world's most valuable company by market capitalization, with dozens of different products supported by an ad network that encompasses everything. Google also has clear and committed enemies, Microsoft, Oracle, Yelp, and even the Motion Picture Association of America that requires restrictions on the power of the company.But according to Matthew Stoller, Open Markets, the best long-term remedy for mastering Google has more to do with Google acquisitions. "If you are looking for a silver bullet, probably would be best to block Google so you can not buy any company," says Stoller. "Suddenly, you have to compete with Google, you can not be bought by Google".This might sound tame compared with fines billion in Europe, but it boils down to the core of the organization of Google. The company has acquired more than 200 new companies since its inception, including core products like YouTube, Android and DoubleClick. The modular structure of the company is probably a direct result of this shopping spree, and it is hard to imagine how Google would look like without him. The most recent purchases like Nest have fallen under the broader umbrella of the alphabet, but the core strategy has not changed.Will Google still be a giant of AI if I had not bought DeepMind? Probably, but everyone involved would have had to work much harder.Even better, the antimonopoly activists have a lot of different ways to block these acquisitions. The antitrust division of the Justice Department has not challenged Google acquisitions so far, but could always change his approach. The strongest solution would come from Congress, where Sen. Amy Klobuchar (D-MN) introduced a bill that would impose a total ban on acquisitions by any company with a capital of more than $ 100 billion market. (At the time of publication, Google is worth about $ 840 billion).

We believe it is no exaggeration to say that this is just the beginning of what could become a story arc that defines the time. And like any good story, this will have major characters and bit players. From what we can tell, one of the lead roles will likely be antitrust chief of the Justice Department, Makan Delrahim, an official of the above dark Administration Trump he is now in charge of one of the most important research in recent memory.

Leaving aside what it could mean for Silicon Valley, the research also will have important ramifications for markets, since then, the shares of large technology companies have been at the forefront of torrid bull market after the crisis. Although the influence of FANG shares in the overall market performance this year has decreased, they remain hugely influential.

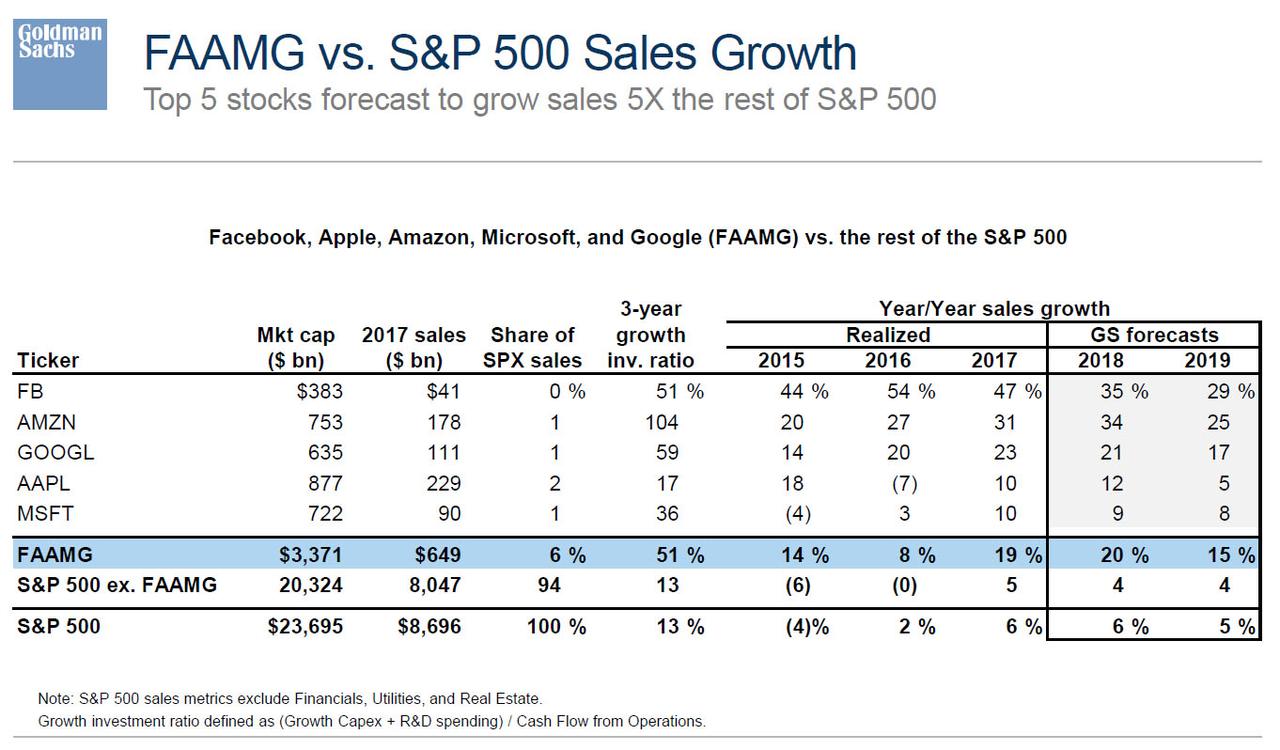

Tech giants are by far the largest contributors to sales growth of SPX ...

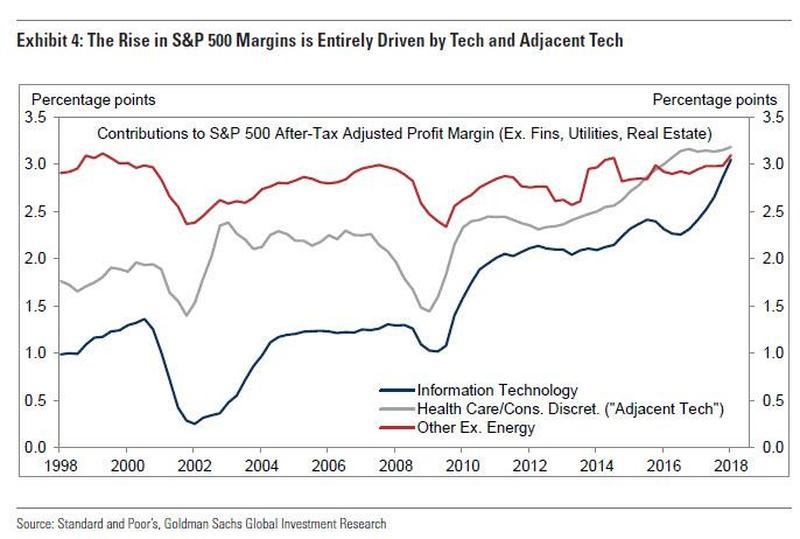

... and they have generated almost the entire margin adjusted profit after tax of SPX from the crisis.

News of the investigation could adversely affect the shares of large technology companies , which in turn will create a serious drag to the major indexes. For investors, it will be a threat to a bull market that is already faltering because the trade war with China President Trump (and now Mexico).

We imagine we 'll hear more about the research through official and unofficial channels in the coming weeks.

Posted by Everth THENANSHED, 1st Officer of the Galactic Federation of Free Planets.

Copyright © misteri1963 All rights reserved. You can copy and distribute this article provided you do not modify in any way the content remains complete, the author receives credit and the URL is included in https: //misteri1963.blogspot. com and copyright notice

Posted by Everth THENANSHED, 1st Officer of the Galactic Federation of Free Planets.

Copyright © misteri1963 All rights reserved. You can copy and distribute this article provided you do not modify in any way the content remains complete, the author receives credit and the URL is included in https: //misteri1963.blogspot. com and copyright notice

No hay comentarios:

Publicar un comentario

No se admiten comentarios con datos personales como teléfonos, direcciones o publicidad encubierta